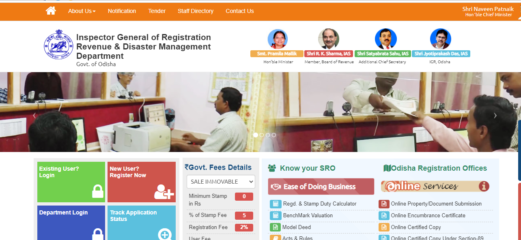

IGR Odisha:- was developed by the Odisha government so that individuals may check out information about the land records that are accessible in the state of Odisha as well as information about the maps that are available for the land records there. On the official website igrodisha.gov.in there is information on the requirements for qualifying as well as the several processes that must be followed in order to effectively get all of the benefits. In this article you get every information regarding this scheme including its objectives, benefits, required documents, eligibility criteria and applying procedure.

IGR Odisha 2023

Inspector General of Registrations Odisha is referred to as IGR. A digital platform for real estate related services has been introduced for the benefit of the people of Odisha. The revenue department of Odisha provides services in the fields of land, revenue, stamp duty and disaster management, among other things. It works with all sides of society. Citizens can use this gateway to access a range of services while still in their homes.

It offers information on real estate, encumbrance certificates and stamp duty payments among other things as part of its computerised services. Promoters must adhere to the project’s timetable as specified at the time of registration with the authorities the government made very clear in the new laws. Beyond the project’s completion date, the allottees shall not be responsible for any extra or higher development fees.

Overview of IGR Odisha 2023

| Name | IGR Odisha |

| Introduced by | Inspector General of Registrations (IGR), Odisha |

| Operated by | Revenue & Disaster Management Department. |

| State | Odisha |

| Beneficiaries | Residents of Odisha |

| Official Website | https://www.igrodisha.gov.in/ |

Objective for IGR Odisha 2023

This portal’s primary objective is to provide people with the tools they need to manage and abide by laws related to the Indian Stamp Act or Indian Registration Act without worrying about someone being physically present at a particular location. The government will also be able to safeguard and monitor information on the population of the state of Odisha, as well as take into account a range of information regarding the land records held by those citizens.

Benefits for IGR Odisha 2023

Below are some of this portal’s benefits:

- The online IGR portal makes it simple and straightforward to register your property in Odisha.

- To improve effective communication among citizens, the organisation promotes group decision making.

- It may be done on the IGR Odisha website through the Revenue and Disaster Management Department of the Inspector General of Registration Odisha.

- The public organisation offers an easy to use registration service that aids in preserving and defending the rights of the government of Odisha and its citizens.

Eligibility Criteria

Below are some of this portal’s eligibility criteria:

- The candidate must reside in Odisha.

Required Documents

The required documents of this scheme is given below:

- Each executor, identifier and claimant must provide proof of identification, such as an aadhaar card, driver’s licence, PAN card, passport or EPIC in order to prove their status as the rightful owner of the asset being sold.

- Photographs of each of the claimants, IDs and executors that are the size of a passport.

- They must submit Form No. 60 in accordance with the Income Tax Act if they are unable to furnish a copy of their PAN card.

- Executors and claimants are required to submit a photocopy of the PAN card if the document is worth more than Rs. 10 lakh.

- Before a SC or ST person transfers the property to a non-SC or ST person the necessary consent must be granted by the tax officer.

- The transfer of the deity’s property requires a NOC or the necessary approval from the endowment’s competent authority.

- If the attorney is the document’s holder, the power of attorney registration and the attorney’s photo identification verification document should both be registered.

- Submission of the encumbrance certificate and the most recent available ROR.

- A specified format statement that has been appropriately signed by the transferor and the transferee is necessary if the property being transferred has no buildings or other structures.

- A legally enforceable statement in the proper form, signed by both the transferor and the transferee must be made if there is a building or other structure on the land.

How to Calculate Registration Fees and Stamp Duty on the IGR Odisha Portal

- First you have to visit the official website of IGR Odisha.

- The homepage will appear on your screen.

- Click on the Regd and Stamp Duty Calculator option.

- A new page will open on your screen.

- Enter all the details such as District, Registration office, Village Thana, KIsan, Plot No, Area, Deed Type and unit.

- Click on the Calculate button to calculate stamp duty and registration charges.