Tamil Nadu Guideline Value :- At the time of title transfer in a certain place, state governments in India set a minimum threshold below which properties cannot be registered. Other names for this rate are circle rate, ready reckoner rate and guideline value. The guideline value GV is more often used in Tamil Nadu. You may see the suggested value on the TNREGINET site. It is the Tamil Nadu Registration Department’s official website. Read the article we get every information regarding this scheme such as required documents, benefits, eligibility criteria, objective, overview and online check procedure.

Tamil Nadu Ennum Ezhuthum Scheme

Tamil Nadu Guideline Value 2023

At the moment of title transfer, Indian state governments establish a minimum below which properties cannot be registered. This rate is known by many other names, including guideline value, circle rate, ready reckoner rate etc. In Tamil Nadu, the use of the guideline value GV is more common. On the TNREGINET portal, you can view the recommended value. It is the official website for the Tamil Nadu Registration Department. Generally speaking the guideline value is less than market value however it may be higher.

The value of a property cannot be lower than the guideline value for registration purposes. Preventing stamp duty evasion is the primary goal of implementing the guideline value. When determining the guideline value, the government takes into account a number of variables, including neighbourhood growth, previous sales at a particular survey number or street etc.

Overview Tamil Nadu Guideline Value 2023

| Name of Scheme | Tamil Nadu Guideline Value 2023 |

| Created By | State Government of Tamil Nadu |

| Beneficiaries | Citizens |

| Objective | Preventing stamp duty evasion is the main goal of applying the guideline value |

| Application Mode | Online |

| Website | https://tnreginet.gov.in/ |

Objective for Tamil Nadu Guideline Value 2023

An online land registry for Tamil Nadu is called TNREGINET. This lessens redundancy and assists in removing the fake document list. Through TNREGINET, we have online access to public records.

Benefits for Tamil Nadu Guideline Value 2023

The benefits for this scheme is given below:

- Real Estate Guideline Value There are crucial elements in Tamil Nadu for the real estate industry.

- If a property is sold for more than the guideline value, the registration will be based on the higher value.

- If you buy a property below the guideline value, you will also be responsible for stamp duty and registration costs based on this lower limit.

- The government sets rules and buyers and sellers decide market values.

- In contrast to market value, guideline value remains constant unless altered by the government.

- Market rates and optimum regulations should exist.

- Capex is anticipated to grow by 15.7% from 2022-2023 (RE) to 44,366 crore in 2023-24.

- According to him, the capex is anticipated to reach 64,683 crore in 2024-2025 and 90,301 crore in 2025-2026.

- As a result, there is less duplication and the fake document list is removed.

Eligibility Criteria

The Eligibility Criteria for this scheme is given below:

- The applicant must live in Tamil Nadu.

Required Documents

The documents needed for this scheme is given below:

- The application must have Aadhaar Card

- Residence Certificate

- Mobile Number

- Draft Deed

- Encumbrance Certificate

How to Determine a Property’s Guideline Value in Tamil Nadu

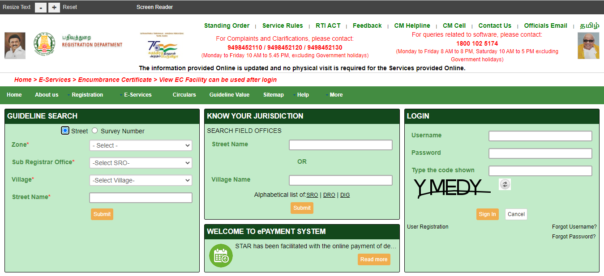

- First you have to visit the official website of the TNREGINET Portal.

- The homepage will open on your screen.

There are two alternatives to verify the Property under the Guideline Search tab:

- Street

- Survey Number

Select one of the options

If you choose the Street and then type the following information:

- Zone

- Village

- Sub Registrar Office

- Street Name

When you click on the survey number, you can then type in the information below:

- Zone

- Village

- Sub Registrar Office

- Survey Number

View the Encumbrance Certificate Procedure

- First you have to visit the official website of the TNREGINET Portal.

- The homepage will open on your screen.

- Click the View EC button after selecting the E-Services option.

A new page will open on your screen with two options to view the Encumbrance Certificate i,e.

- Document-Wise

- Plot/Flat-Wise

Select one of the options.

Enter all the required details such as zone, district, EC start date, end date and survey details.

Enter the captcha code.

Click on the Submit button.